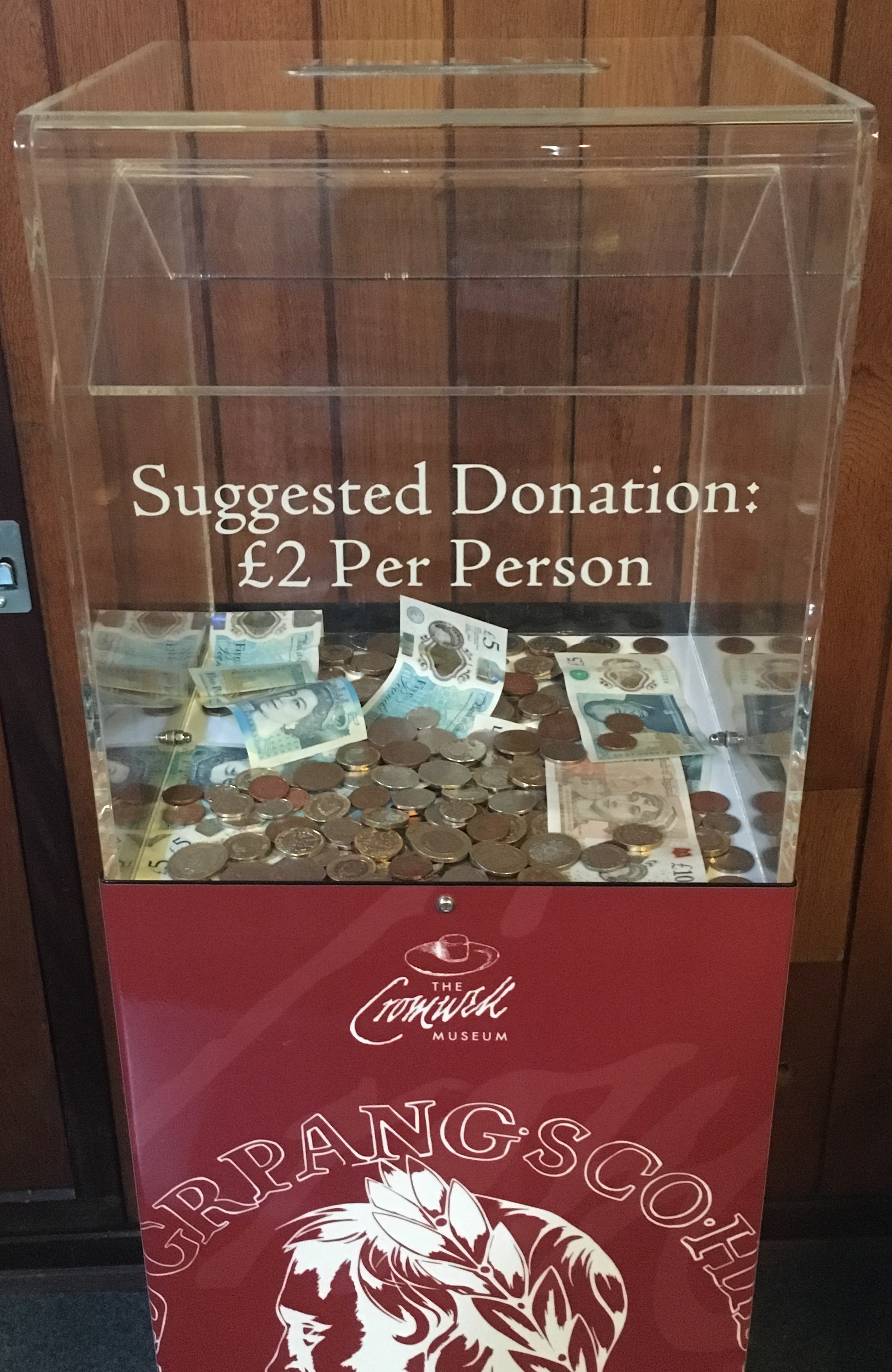

The Cromwell Museum Trust as an independent museum does not receive central government funding and depends on donations from our visitors and interested parties to help fund our activities. We are extremely grateful for any contributions, no matter how large or small.

- £5 can fund a school holiday activity for a local child at the museum

- £10 can pay for an archive storage box to help to properly conserve some of our collection

- £100 can help pay for the conservation of a fragile object

- £150 can help pay for a day’s running costs of the Museum

- £500 can pay for a batch of leaflets to promote the Museum

- £1,000 can pay for a temporary exhibition

We also have larger Special Projects which we would be delighted to talk to you about if you would like to make a larger donation tied to a specific purpose. Please contact our curator at [email protected] if you would like more information.

Help us liberate money from the Tax Man!

As a registered charity we can claim Gift Aid on donations from UK tax payers and thereby increase the value of your kind contribution. If you pay UK income tax or capital gains tax that is at least equal to the amount you are donating in any one tax year, we can reclaim tax on the donation, so we would be very grateful if you would complete a Gift Aid Declaration Form.

How to donate:

- Cheques etc made payable to "The Cromwell Museum Trust" can be sent to: The Cromwell Museum, Grammar School Walk, Huntingdon, PE29 3LF

- Donations in person can be made at the Museum in cash, by cheque or by credit/debit card.

- We also can take online donations – click the button to the right to do so.

Legacy Donations

Leaving a gift to charity in your will is a very special way of helping the Cromwell Museum.

If you leave the Cromwell Museum Trust, a registered charity, a bequest in your will, the amount will be exempt from inheritance tax and this could reduce or even eliminate tax which might otherwise be payable out of your estate. We would suggest however that it is always advisable to have your will made by a solicitor who will be able to give you all the legal and tax advice you require.

The two main types of gift are:

Residuary bequest

This is the balance of your estate after tax (if any), expenses and other types of legacies have been paid. You can leave the whole, or a share of the residue to the Cromwell Museum.

Pecuniary legacy

This is an exact sum (e.g. £5,000)

With the passage of time, pecuniary (cash) legacies will lose value because of inflation and you may wish therefore to review your will every few years. Alternatively, you can index-link your cash gifts to family, friends, and charities, or divide your whole estate into shares or percentages, so that each of your beneficiaries will gain if the value of your estate increases between the time of making your will and your death.

How to word your bequest

It is very important that wills are written accurately and it may be helpful to you and your solicitor to know how to phrase a bequest in favour of the Cromwell Museum.

You should ask your solicitor to ensure the following are included in your bequest:

- Our name – The Cromwell Museum Trust

- Our address – The Cromwell Museum, Grammar School Walk, Huntingdon, PE29 3LF

- Our charity registration number - 1166233

- You should also include the phrase 'I declare that the receipt of the Treasurer or any other proper officer shall be sufficient discharge therefore'.

The Cromwell Museum Trust is a UK registered charity, No. 1166233.